More Homes for Sale Isn’t a Warning Sign – It's Your Buying Opportunity

Maybe you’ve heard the number of homes for sale has reached a recent high. And it might make you question if this is the start of another housing market crash.

But the reality is, the data proves that’s just not the case. In most areas, more inventory isn’t bad news. It’s actually a sign of the market returning to a more stable, healthy place.

What’s Going on With Inventory?

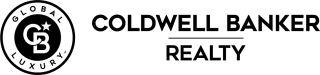

Based on the latest data from Realtor.com, inventory just hit its highest point since 2020, shown with the white line in the graph below.

But what you need to realize is, at the same time, inventory levels still haven’t returned to pre-pandemic norms (shown in gray):

That means there are more homes for sale now than there have been in quite some time.

And while it’s true inventory is up significantly compared to where it was over the last few years, the number of homes on the market is still well below typical levels. And that’s important context.

Why This Isn’t the Problem A Lot of People Think It Is

Some people hear inventory’s rising and immediately think about 2008. Because back then, inventory spiked just before the market crashed. But today’s situation is very different.

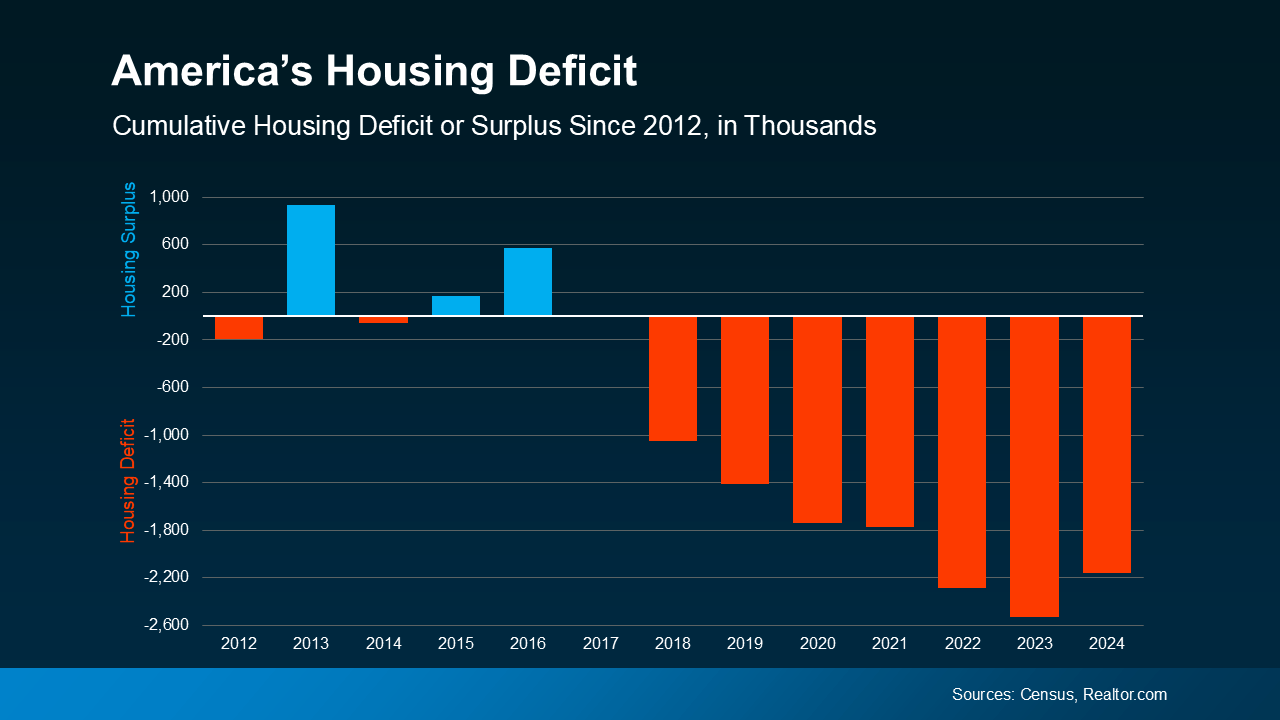

Here’s the key reason why. We don’t have a surplus of homes; we have a deficit to climb out of. What we’re dealing with is a long-term housing shortage – and it’s a big one.

The red bars in the graph below show all the years where housing starts (new builds) didn’t keep up with household formation, going all the way back to 2012. The deeper the bars in the graph, the more the housing deficit grew (see graph below):

And one of the reasons this housing shortage kept growing is because new home construction just didn’t keep up with the number of people who need to buy homes. In fact, the U.S. is actually short millions of homes at this point, and it will take years to overcome that gap. Realtor.com says:

“At a 2024 rate of construction relative to household formations and pent-up demand, it would take 7.5 years to close the housing gap.”

That means, in most areas, there isn’t a risk of having too many houses on the market right now. It’s quite the opposite – a vast majority of markets actually need more homes.

Which is why, even though inventory is rising, it’s not a problem on a national scale. It’s just helping to fill a gap that’s been growing for years.

Bottom Line

Don’t let the headlines scare you. Rising inventory isn’t a sign of a crash. It’s a step toward a more normal, stable housing market.